How BPC cleared $578m in unpaid bills in three months

Amin Ul Ahsan, chairman of BPC, which is responsible for oil and petroleum imports, distribution, and marketing, credited the swift debt clearance to strategic shifts that restored the agency’s image and strengthened its bargaining power with suppliers

The Bangladesh Petroleum Corporation (BPC) has settled $578 million in unpaid foreign bills during the last three months, an achievement it had struggled to accomplish over the previous two years.

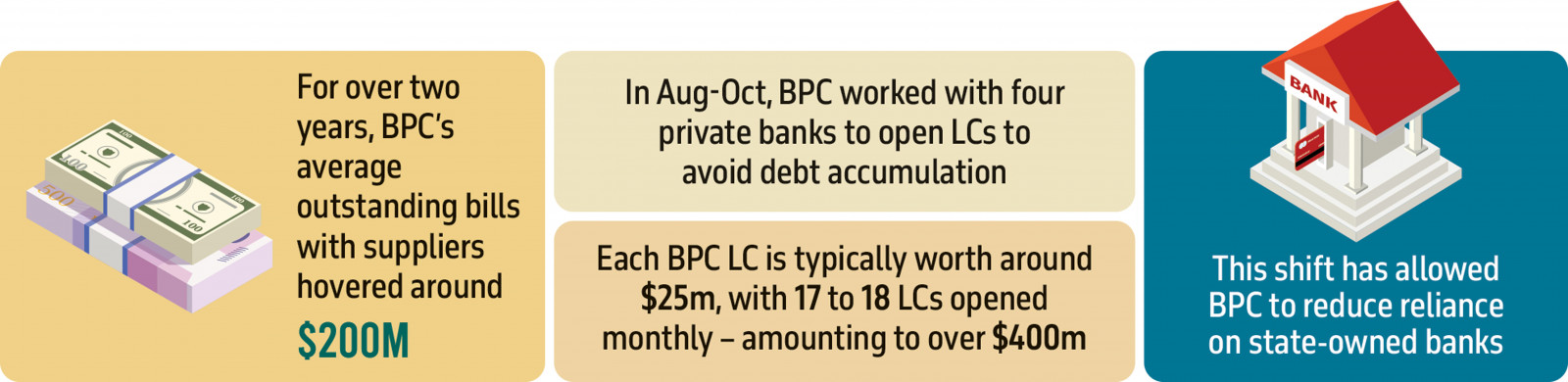

For more than two years, the state-owned agency's average outstanding bills with suppliers hovered around $200 million, with ships at times forced to wait offshore at Chattogram Port, unable to unload due to unpaid dues – resulting in increased rental and demurrage costs.

Amin Ul Ahsan, chairman of BPC, which is responsible for oil and petroleum imports, distribution, and marketing, credited the swift debt clearance to strategic shifts that restored the agency's image and strengthened its bargaining power with suppliers.

"As of 7 November, the BPC holds no outstanding foreign payments. One major reason is our decision to open letters of credit (LCs) through private banks, which have adequate foreign currency reserves," Amin told The Business Standard yesterday.

In the past three months, the BPC has worked with BRAC Bank, Prime Bank, The City Bank, and Islami Bank to open LCs, successfully avoiding further debt accumulation. Each LC by the corporation is typically worth around $25 million, with 17 to 18 LCs opened monthly – amounting to over $400 million, a demand that state-owned banks alone could not sustain.

This shift has allowed the BPC to reduce its reliance on state-owned banks like Sonali Bank, which, during this transition period, supplied foreign currency to settle deferred payments on previously opened LCs that had been delayed due to foreign currency shortages.

Due to the shortages, the previous Awami League government instructed the Bangladesh Bank to supply dollars for importing essential commodities, including fuel oil, food, and chemical fertilisers.

According to central bank data, the Bangladesh Bank provided $7.62 billion in FY22, $13.58 billion in FY23, and $12.79 billion in FY24 to commercial banks. However, as the country's foreign exchange reserves declined, the central bank was unable to meet the full demand for dollars, resulting in a gradual increase in BPC's debt to foreign suppliers for fuel oil imports.

BPC Chairman Amin said reliance on Sonali Bank and other state banks has been completely reduced. During this period, Sonali and other banks cleared BPC's foreign exchange dues from previously opened LCs, thanks to increased remittances.

He said the energy adviser also directed state bank managing directors to ensure the necessary foreign exchange for BPC.

Amin added that foreign suppliers are now satisfied, as BPC has improved its payment timeliness and negotiation strength. The BPC is set to sign a six-month oil supply contract in December without any weakness in negotiations.

He said there is no additional cost for opening LCs at private banks. Dhaka Bank and Bank Asia have also shown interest in opening LCs, with these banks expected to begin next week. Additionally, BPC plans to open LCs with Standard Chartered Bank in January.

Previously, BPC only used four state banks for LCs, but now it is using nine banks, both public and private. This expansion has eased the pressure on the banks and made the process smoother for BPC.

As the sole importer of fuel oil in the country, BPC purchases fuel in foreign currency and sells it in local currency. Aside from arrears, Bangladesh Biman is the only entity without any dues from the sale of fuel. BPC opens oil import LCs in foreign currency with local currency through banks.

Following the increase in import demand after the Covid-19 pandemic and the rise in global commodity prices due to the Russia-Ukraine war, Bangladesh faced a foreign exchange crisis.

As export and remittance income failed to meet import liabilities, foreign exchange reserves continued to decline, and the exchange rate of foreign currencies continued to rise.

To meet market demand, the Bangladesh Bank struggled to supply dollars from its reserves. Despite having funds available, various entities were unable to access dollars. As a result, BPC was unable to settle dues with foreign suppliers on time, turning into a debtor institution.

On 20 October, Bangladesh Bank Governor Ahsan H Mansur said in an interview with UNB that the country's foreign exchange reserves are gradually increasing and stabilising.

He noted that under the previous government, reserves were declining by $1.3 billion per month, but now the trend is reversing positively.

"A significant amount has already been paid for fertiliser, electricity, and Adani-Chevron dues. In the last two months alone, the central bank cleared $1.8 billion in arrears for fuel and other essential services, reducing the outstanding bill from $2.5 billion to $700 million," the governor added.

Keep updated, follow The Business Standard's Google news channel

Keep updated, follow The Business Standard's Google news channel